Unprecedented pub closures continue to shake up UK drinks industry

30th March 2023

Latest statistics from CAMRA (Campaign for Real Ale) show that 21 pubs a week are closing for business in the UK and face an uncertain future, with customers tightening their belts and energy bills set to hit new highs from 1st April.

Although a welcome measure, the 11p draught duty cut in Chancellor Hunt’s spring budget announcement did little to alleviate the financial squeeze on pubs and bars across Great Britain, many of which sit at the hearts of their local communities.

Pub closure statistics revealed by the consumer organisation CAMRA show that, in the second half of of 2022, an astounding 554 pubs have closed for business or are standing empty without tenants.

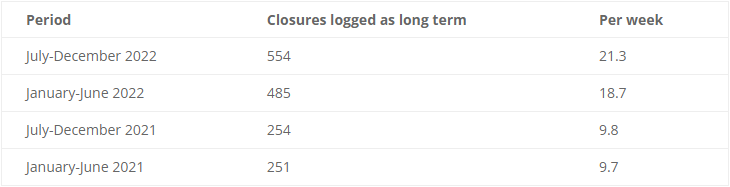

Moreover, the number of long-term closures over the last four data sets show a concerning trend over the last couple of years:

CAMRA Pub Closure Report figures showing long-term closures in 2021-2022.

The shocking figures have prompted CAMRA to call on the government to invest in a dedicated support package to prevent the collapse of more drinks businesses.

“These figures should be an urgent wake-up call for the Government,” said CAMRA chairman Nik Antona, adding that pubs play a crucial role in bringing people together and tackling loneliness and social isolation.

“With the cost of doing business rocketing, energy costs sky-high and customers tightening their belts, it is little wonder that hundreds of pubs across the country are closing for business or are standing empty. We know that the licensed trade can thrive and drive growth in the economy, but only if the Government acts quickly,” he stressed.

Another survey, conducted jointly by the British Beer and Pub Association (BBPA), UKHospitality, the British Institute of Innkeeping (BII) and Hospitality Ulster, showed that 35% of respondents were expecting to be operating at a loss or be unviable by the end of 2022.

Meanwhile, 77% of operators were reporting a decrease in people eating and drinking out, with 85% expecting this to worsen going forwards. As a result, 89% are either not confident or pessimistic that the current levels of support offered by government will protect the industry in the next six months.

The BBPA said in a joint statement: “The results clearly lay out the stark situation facing hospitality businesses, with many on the brink due to the cost of doing business crisis.

“The vulnerability of the sector due to soaring energy costs, crippling rises in the cost of goods and dampening consumer confidence is on full display in this survey and if urgent action isn’t taken, it is looking incredibly likely that we will lose a significant chunk of Britain’s iconic hospitality sector in the coming weeks and months.”

According to data from property experts Altus Group, there were 39,787 pubs in England and Wales at the end of 2022, down by over 6% from the end of 2017. Whereas, in January 2023 alone, a further 49 pubs have called last orders once and for all, falling victims to the escalating crisis.

Alex Probyn, global president of property tax at Altus Group, commented: “High operating costs and low margins make plots attractive for alternative investment and use so continued support is vital to protect pubs as they play an important role at the heart of their local communities.”

Energy bills set to jump almost £20k next month

As the end of the government’s energy relief for businesses looms, pubs and breweries across the country are dreading the cliff edge, with average energy bills for pubs expected to soar by £18,400 a year on 1st April.

The end of the scheme will add further pressure to a sector that is already struggling to retain profit margins. Hence, the BBPA is urging the Government to insist suppliers offer a window for renegotiation to allow businesses locked into sky high rates to recover their cost base.

Emma McClarkin, chief executive of the association, said: “This has been a critical issue for our sector for far too long and as the 1st April draws closer, we have reached a point where businesses have nowhere left to go, as costs increase, and their profit margins are completely erased.

“Last week [15th March], the Government extended energy support for consumers but left businesses out in the cold, in doing so the Chancellor recognised the UK’s energy market is broken but to date has done little to fix it.

“As a result, pubs and breweries are now doing all they can to prepare for an extreme hike in costs come 1st April, with some expected to pay almost £20k more for their bills than the day before.”

While energy support for hosueholds will continue, the government is ending the Energy Bills Relief Scheme for businesses on 1st April.

Ms McClarkin warned that without government intervention, thousands of pubs and breweries will be at risk of closure from April onwards and many will be lost from communities across the country forever.

Joanne Farrell, who runs The Windsor Castle near Stockport, admitted she had to take drastic measures to keep the pub open for business as a result of the energy crisis.

“When energy costs rocketed my bills went up threefold, the end of the support will see them rise even further. I’ve run this pub for 15 years, but this is the toughest it’s ever been to keep it going,” she said.

“I’m doing absolutely everything I can to save on energy costs, but I also want my pub to remain a welcoming and warm place local people can enjoy. I’ve installed a wood burner which saves me money and I’m hoovering in the dark so I’m not paying for electricity when there’s no customers in.”

Likewise, Keris de Villiers, of the Pig & Whistle in Wandsworth, said in 10 years of running the pub, she has never found it so difficult to turn a profit.

“We got through Covid, but the cost-of-living crisis is worse… costs on everything across our business from energy to ingredients have rocketed,” she said.

Meanwhile, Emma Shepherd, who runs The Blue Ball Inn in Worrall, Yorkshire, said her fixed rate electricity contract is due to end shortly and she is struggling to find a new provider. She even received a quote for a standing charge rate that would be a 1000% increase on what she currently pays.

According to accountancy group UHY Hacker Young, the current economic downturn has been the final push into insolvency for many pub and bar owners. Data from last year shows that insolvencies of pub and bar companies have risen by 83%, from 280 in 2021 to 512 in 2022.

Peter Kubik, head of turnaround and recovery in the group’s London office, said: “This is a particularly difficult period for pub and bar owners, who find they need to spend more and more while earning less and less. Following an extended period of lost revenues during the pandemic, the cost-of-living crisis has been the final nail in the coffin for many.”

Lack of immediate support in spring budget

Jeremy Hunt’s spring budget was branded a “make-or-break” moment by various organisations, who were hoping to see measures that would rebalance the “catastrophic impact” unfair energy contracts and soaring inflation are having on British pubs and breweries.

While a number of measures were welcomed by the industry, the lack of immediate support is set to put more businesses at risk, Emma McClarkin from the BBPA pointed out.

“This Budget was a make-or-break moment for pubs and brewers who have been running out of road for too long, and whilst the Chancellor’s efforts to support our pubs and breweries are welcome, we look forward to seeing how the “Brexit Pubs Guarantee” will deliver for our sector.

“The cut to draught duty as part of the alcohol duty reform is positive and we hope that it will result in a boost for our pubs this summer,” she noted. “However, the fact is, our industry will be facing an overall tax hike not a reduction come August.

Ms McClarkin stressed the BBPA will continue to work with the government to resolve fundamental issues in the UK hospitality sector, including reforming business rates and reducing the unfair tax burden on pubs and breweries.

Commenting on the new draught duty rate for beer and cider, CAMRA national chairman Nik Antona said: “The Chancellor has made a welcome move to increase the draught duty rate discount to 11p, which will help pubs compete with the likes of supermarket alcohol.

“However, the lower tax rate is not coming until August, and we must hope that as many pubs as possible will be able to keep their doors open until then,” he added.

Meanwhile, James Simmonds, partner at UHY Hacker Young, said the tax reform was “a tonic for the struggling pub trade”.

“For pub companies this couldn’t come soon enough. The soaring price of beer is putting off pub customers. Anything that helps put a lid on the price of a pint is going to be very welcome.”

However, like Mr Antona, he expressed concerns over businesses maintaining viability until the new law comes into force on 1st August.

Another small win for the sector in this year’s spring budget was the announcement of the new Small Producer Relief Scheme, which will allow small breweries and cider makers to pay less tax, helping to compensate for the economies of scale enjoyed by larger manufacturers.

Mr Antona commented: “With stubbornly high inflation and the impending cliff-edge drop-off in energy bill support, small producers need more help than ever to compete with the purchasing power and economies of scale enjoyed by the global producers that dominate the UK beer and cider market.

“Small cider makers will also benefit from a progressive duty system for the first time ever, supporting them to grow and increase choice of artisanal ciders for consumers.”

He added the organisation is pleased to see the reforms will apply to Northern Ireland, including the Small Producer Relief Scheme. “Northern Ireland has a growing independent small beer and cider scene, and those producers need to be supported in their quest to increase choice for consumers,” Mr Antona said.

While the new reforms announced in the budget represent a glimmer of light for UK pubs and bars, further action is needed to reinstate stability in the UK hospitality sector.

“Business rate relief schemes currently in place in England are due to end in 2024, so the Government needs to act soon. Pubs pay a grossly unfair portion of the total business rates bill, and proper reform is the only permanent fix to the issue. This will be a main focus for us when we launch our campaigning ahead of an expected Autumn fiscal event,” Mr Antona concluded.